Is Ozempic® Covered by Insurance? A Complete Guide to Coverage, Alternatives, and Saving on Costs

Ready to say goodbye to the old struggle of endless attempts and giving up before you even see results? If you haven’t heard already, there’s something that might just make getting in shape a little easier—yes, it’s Ozempic®.

However, Ozempic®’s high cost—ranging from $1,000 to $1,200 per injection pen—can be a barrier for many people. This is why–understanding if Ozempic® is covered by insurance is essential for those looking to manage their health affordably.

As the popularity of the Ozempic® grows, so does the curiosity surrounding its accessibility. With the rise in demand and interest in the Ozempic®, many are left wondering: How much does the Ozempic® cost, does insurance cover it, and what insurance covers it? This comprehensive blog will answer these questions and explore savings options.

What Is Ozempic® and How Does It Work?

Ozempic® belongs to a class of medications called GLP-1 receptor agonists. GLP-1 (glucagon-like peptide-1) is a naturally occurring hormone that helps regulate blood sugar levels. By mimicking the effects of GLP-1, Ozempic® helps to:

- Increase insulin secretion after meals

- Decrease glucose production in the liver

- Slow down the stomach’s emptying process, promoting a sense of fullness

These effects make Ozempic® effective for managing Type 2 diabetes by regulating blood glucose levels. Additionally, it aids in weight loss due to its appetite-suppressing qualities. While Ozempic® is FDA-approved for Type 2 diabetes, it’s sometimes prescribed off-label for weight loss. To learn more about how Ozempic® and other GLP-1 medications lower blood sugar levels, check out our guide on Does Semaglutide Lower Blood Sugar? Exploring Its Effects and Benefits.

How Much Does Ozempic® Cost Without Insurance?

The cost of Ozempic® without insurance can be a financial strain. Without insurance coverage, Ozempic®’s list price is approximately $968 per injection pen, but retail prices range from $1,000 to $1,200, depending on:

- Pharmacy location

- Dosage prescribed

- Geographic location

These costs can accumulate because Ozempic® is often intended for long-term use. Understanding insurance coverage or finding discount programs can significantly reduce the out-of-pocket cost of Ozempic®.

Insurance Coverage for Ozempic®

Determining if insurance covers Ozempic® depends on multiple factors, including the reason for its use (Type 2 diabetes vs. weight loss) and specific insurance policies.

When Is Ozempic® Covered?

Usually, Ozempic® is covered by insurance if prescribed for Type 2 diabetes. This includes private insurance, Medicare, and Medicaid plans listing Ozempic® in their formulary. However, coverage is more limited if prescribed for off-label weight-loss purposes, as many insurance plans do not cover weight-loss medications except under specific conditions.

Types of Insurance and Coverage Policies

1. Private or Employer-Sponsored Insurance

Most private or employer-sponsored insurance plans cover medications like Ozempic® if medically necessary. To qualify, you may need to meet specific criteria, such as a minimum BMI or a confirmed Type 2 diabetes diagnosis.

Weight-loss prescriptions, including Ozempic® for weight management, often have stricter coverage requirements and may require a doctor’s documentation for prior authorization.

2. Medicare

Medicare Part D may cover Ozempic® if prescribed for Type 2 diabetes. Medicare Advantage plans, which include prescription coverage, also generally follow Part D guidelines.

However, Medicare does not cover medications used solely for weight loss, so Ozempic®, which is prescribed solely for weight loss, may not qualify for coverage.

3. Medicaid

Medicaid coverage varies by state, but it usually provides prescription drug benefits, including medications for managing chronic conditions like Type 2 diabetes.

Contact your state’s Medicaid agency to confirm if Ozempic® is covered under your plan, mainly if prescribed off-label for weight loss.

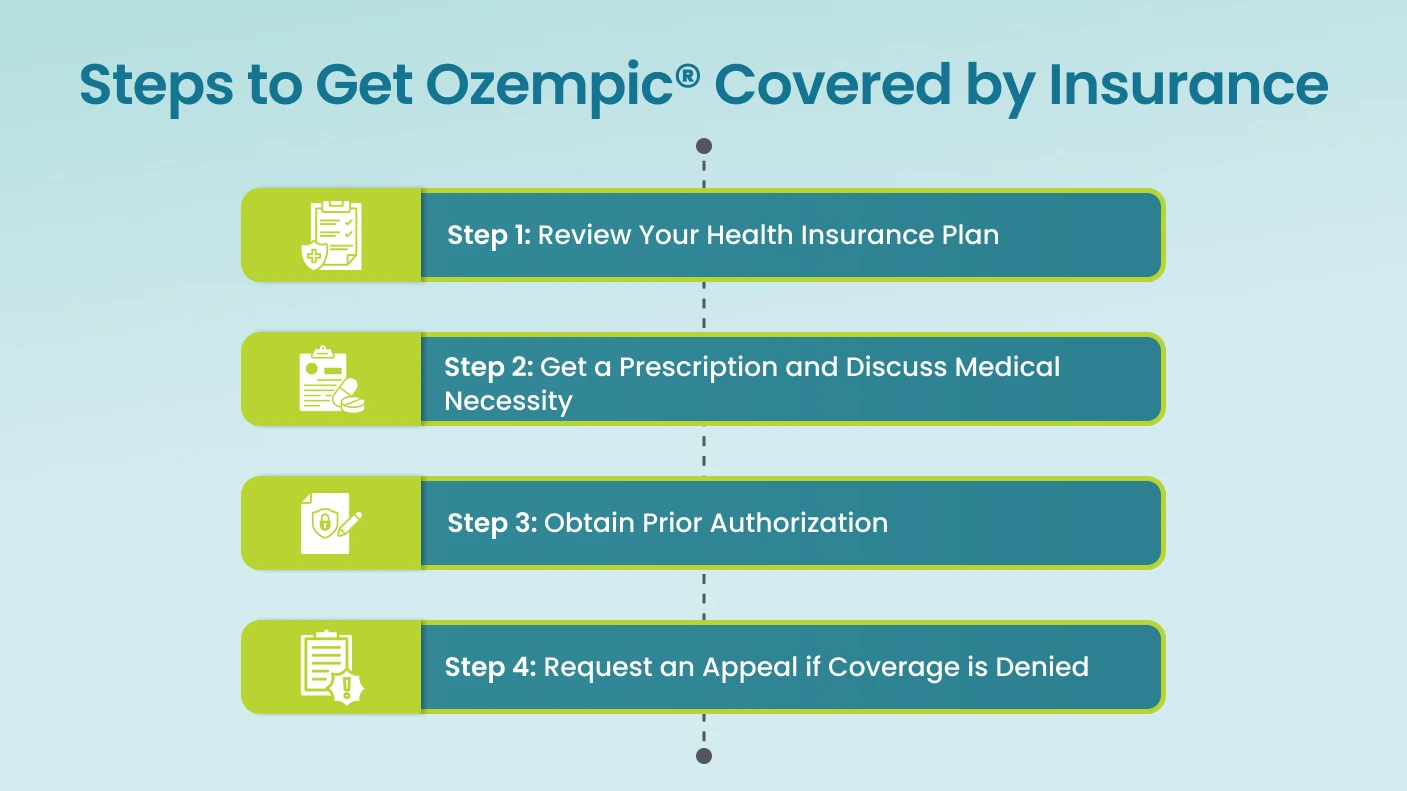

Steps to Get Ozempic® Covered by Insurance

Navigating insurance coverage for Ozempic® can feel complex, but these steps may help increase your chances of getting coverage for this medication:

Step 1: Review Your Health Insurance Plan

Start by carefully reviewing your health insurance plan’s formulary (the list of medications covered by your plan) to see if Ozempic® is included. Look for details about whether Ozempic® is covered under your current plan and what conditions. Many plans require a specific diagnosis, like Type 2 diabetes, for coverage. Understanding the formulary language can give you a clear picture of your potential out-of-pocket costs and whether a copay or coinsurance is involved.

For further clarity, you may contact your insurance provider to confirm the details and see if there are any restrictions on Ozempic® coverage, especially if you plan to use it for weight management or insulin resistance.

Step 2: Get a Prescription and Discuss Medical Necessity

Make an appointment with your healthcare provider to discuss Ozempic® treatment options. During your visit, your provider can evaluate your condition and determine if Ozempic® is medically appropriate. Medical necessity is crucial in obtaining insurance coverage, especially for conditions not typically covered by your plan.

If you’re seeking Ozempic® for off-label use (such as weight loss), your provider can document any additional health concerns, such as obesity or metabolic syndrome, that support its necessity. Your provider’s thorough documentation may strengthen your case if prior authorization or an appeal is required later.

Step 3: Obtain Prior Authorization

Many insurance plans require prior authorization for Ozempic®, especially for uses beyond Type 2 diabetes. Prior authorization is an approval process where your healthcare provider submits documentation to confirm that the medication is essential for your treatment. If prior authorization is required, your provider must outline why Ozempic® is medically necessary for you based on your health history and current condition. This step can take some time, so starting the process early is essential.

Remember that even with prior authorization, some plans may limit the number of doses or impose other restrictions. Hence, it’s helpful to review the specifics of your approval once it’s granted.

Step 4: Request an Appeal if Coverage is Denied

If your insurance provider initially denies coverage for Ozempic®, you can submit an appeal. In an appeal, you or your healthcare provider can provide additional evidence and detailed medical documentation to demonstrate why Ozempic® is necessary for your health. This may include a letter from your doctor explaining the potential benefits of Ozempic® in your specific case, along with any supporting documentation of previous treatments and their limitations. A board or medical professional often reviews appeals within the insurance company, so presenting a well-supported case can make a significant difference. Persistence is vital, as some patients receive approval after multiple appeals.

By following these steps and working closely with your healthcare provider, you may improve your chances of obtaining insurance coverage for Ozempic®. Always communicate with your insurance provider and clarify any uncertainties to help you make the best financial and health-related decisions.

Patient Assistance Programs and Savings Options

For those without insurance coverage or with high out-of-pocket costs, several programs can help make Ozempic® more affordable.

-

Manufacturer Programs

Novo Nordisk, the manufacturer of Ozempic®, offers a Patient Assistance Program for eligible individuals. To qualify, you must meet specific criteria such as being a U.S. citizen or legal resident, falling below a certain income level, lacking insurance, or having Medicare.

-

Coupons and Discount Programs

Platforms like GoodRx provide savings coupons for Ozempic® that can lower participating pharmacies’ costs. Discounts can be as much as $100 to $200 monthly, significantly reducing out-of-pocket expenses. Some savings cards offered by private insurance companies or other healthcare networks may allow patients to pay as little as $25 per month for a supply of Ozempic®, although eligibility varies.

We’ve answered a few high-burning questions in the following section that may help you further.

Meet Your Most Healthiest Version with Ozempic® by IV Drips

Ready to embrace a sustainable path to weight loss and feel your best? Discover the benefits of Ozempic® through IV Drips, with a clinically proven program tailored to support your unique health goals. Starting at just $475, our customized Semaglutide options offer effective appetite control and metabolic support, helping you make meaningful strides toward lasting wellness.

Our comprehensive online program provides a personalized dosage plan, unlimited follow-ups with experienced professionals, and medication conveniently delivered to your doorstep. IV Drips equips you with the tools and support for a confident wellness journey from tailored dietary guidance and habit transformation to ongoing counseling and attentive medical supervision.

Take the next step toward your healthiest self—contact us today to Lose Weight!

Frequently Asked Questions (FAQs)

- How much does Ozempic® cost with insurance?

The cost of Ozempic® with insurance can vary significantly based on your specific insurance plan and whether your insurer considers the medication medically necessary. Most patients can expect to pay a copay or coinsurance fee, typically $25 to $100 or more, depending on the plan’s terms. Checking with your insurance provider can give you a clearer picture of Ozempic®’s cost with insurance under your coverage.

- Will insurance cover Ozempic® for weight loss?

Insurance coverage for Ozempic® for weight loss is generally limited, as most insurance plans do not cover weight-loss medications. However, some plans may offer benefits for managing weight-related health conditions. Since Ozempic® insurance coverage can vary, it’s a good idea to contact your insurer directly to confirm their policy, especially if you want to use Ozempic® for weight loss.

- Who can prescribe Ozempic® for weight loss?

A licensed healthcare provider, such as a general practitioner, endocrinologist, or obesity specialist, can prescribe Ozempic® for weight management. However, insurance coverage often depends on whether Ozempic® is prescribed for Type 2 diabetes or weight loss. If you’re considering Ozempic® for weight loss, check with your insurer about the qualifications for Ozempic® to be covered by insurance in this case.

- Will insurance cover Ozempic® for prediabetes or insulin resistance?

Coverage for Ozempic® for prediabetes or insulin resistance is not usual, but some insurance providers may approve it if Ozempic® is considered necessary to prevent progression to Type 2 diabetes. Since every insurance plan varies, it is best to confirm with your provider if Ozempic® for insulin resistance or prediabetes would be eligible for coverage.

- What are the qualifications for Ozempic® to be covered by insurance?

To qualify for Ozempic® insurance coverage, most insurers require a confirmed diagnosis of Type 2 diabetes. Additional qualifications may include prior authorization and a demonstrated medical necessity by your healthcare provider. Some insurance companies also have specific criteria, such as certain BMI thresholds or previous treatments tried, which can impact your eligibility. Checking your insurance plan’s requirements can help clarify if you meet the qualifications for Ozempic® to be covered by insurance.

Ultimately, discussing your options with your healthcare provider and exploring financial assistance programs can ensure you get the treatment you need at a price that fits your budget. And if your insurance fits the Ozempic® treatment, IV Drips is the place to get it!

Posted on behalf of IVDrips